Do Credit Report Apps Really Work? – NBC 7 San Diego

[ad_1]

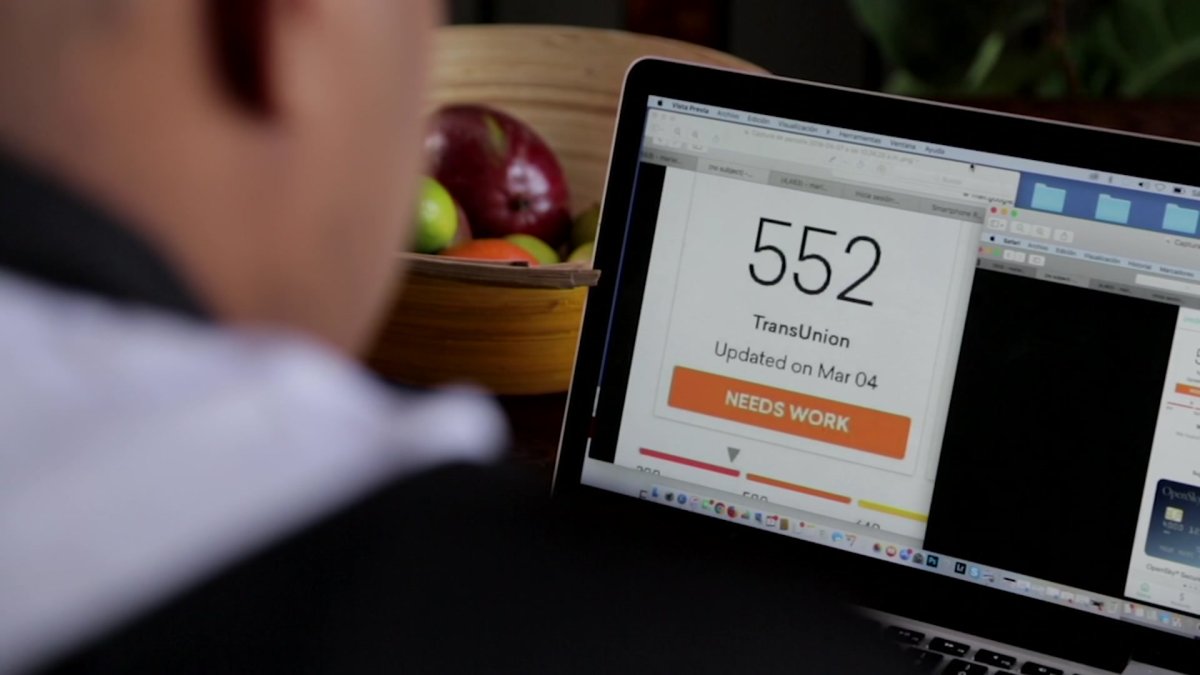

Credit scores are used for everything from taking out a mortgage to looking for a job. So it only makes sense to know your creditworthiness. But how do you get it? Apps that promise instant access to your score are popular, but do they work? A fresh investigation into consumer reports may make you think twice before clicking to get your score.

Creditworthiness apps like Credit Karma, Experian Credit Report, and others promise instant access to creditworthiness, along with other features like score monitoring. Sounds great until you dig a little deeper. Consumer Reports shows that five of these apps have significant drawbacks and few advantages.

CR’s investigation found that the apps can pose serious privacy risks, and what is worse, a survey of consumers who have used them found that in some cases the apps did not even provide an accurate credit score.

And four of the five researched apps that CR looked at often charge users a fee to access their credit reports, which consumers are legally entitled to free of charge, while not providing access to the type of credit most lenders do use.

Several of the apps use the VantageScore 3.0, which has limited value as many lenders don’t use it.

A political analyst at Consumer Reports says consumers should have a legal right to get a free, accurate credit score, and there is a bill in Congress that would mandate it, but no vote has yet been scheduled.

CR has a petition on action.consumerreports.org seeking 40,000 signatures to be sent to Congress asking it to work a little harder and faster on this issue.

CR surveyed all five credit app companies about their consumer protection, data collection and data sharing practices. All replied, saying that they take consumer privacy very seriously and that consumer trust is paramount to their business.

Remember, there are ways you can get your credit score without using a credit score app. Check that your debit or credit card gives you access. And you can also check your credit report weekly for free through annualcreditreport.com.

Since your credit report has an impact on your creditworthiness, you should check it regularly and dispute any errors in writing immediately.

[ad_2]

Source link